REVEALED:

The Unauthorized List of

Nvidia’s Silent Partners …

Nvidia’s official partners have brought back returns of 712%, 1,267%, and even 1,385%.

But it’s a small group of their Silent Partners who could have

the most explosive potential in 2026.

Dear Reader,

Nvidia recently became the world’s first $5 trillion company.

Their market cap is now greater than the entire stock markets of countries like Canada, the U.K., France, Germany and Italy.

Their most expensive chip, Blackwell, is so popular it’s been on back order for over a year.

They can cost as much as $70,000 …

The average AI data center needs thousands of these chips.

Some of the biggest companies in the world are clamoring for their share.

Including tech giants like Microsoft, Meta, Google and Amazon.

Heck, even Elon Musk is begging to spend $18 billion to get his hands on some Blackwells.

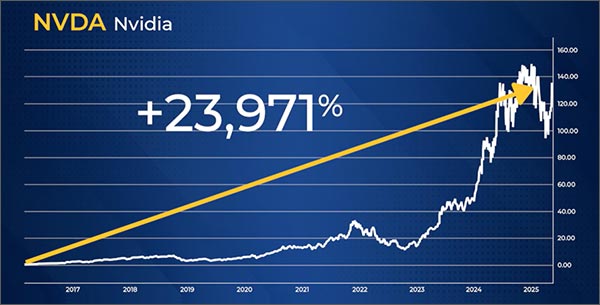

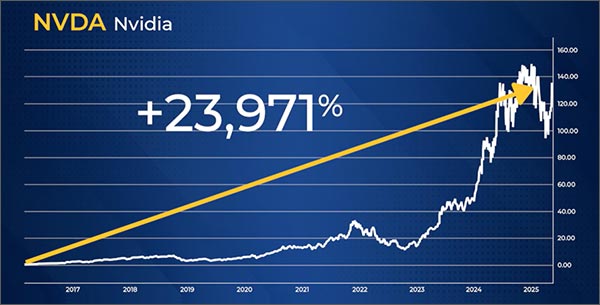

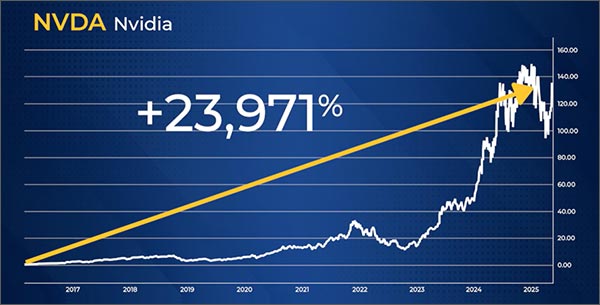

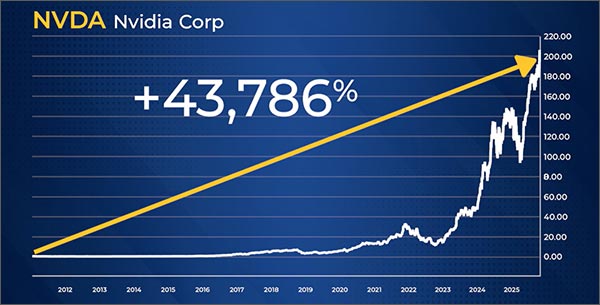

Since I first picked Nvidia back in 2016 …

When it was just a split-adjusted 80 cents …

Their stock has gone up 23,971% …

Making them easily one of the best picks I have made in my career.

But Nvidia has not ascended alone …

Several companies working with them over the years have also done well.

Here are some of the top performers …

Take TD Synnex …

They are the world’s largest global IT solutions distributor.

Since they first partnered with Nvidia in 2013 …

Their stock has gone up 712%.

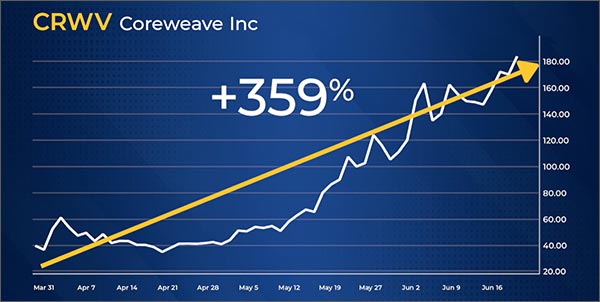

CoreWeave started working with Nvidia in 2020 …

That’s when they established a business renting Nvidia’s popular GPUs in the cloud.

They just had their IPO earlier this year.

In less than three months, CoreWeave’s stock went up 359%.

Nebius is a leading AI infrastructure company.

They recently announced the launch of their first Nvidia GPU cluster in the United States.

Nebius’ stock went up 556% in less than 11 months after that announcement.

Dell Technologies is a global leader in IT hardware, software and services.

They’ve been working with Nvidia since August 1997 …

Back when Dell was integrating Nvidia’s GPUs into their PCs.

They’ve gone up 1,385%.

And ASUS is a leading computer hardware and electronics company.

They’ve been collaborating with Nvidia for nearly 30 years.

Anyone can find these companies.

They are all listed on Nvidia’s website …

Among a group nearly 1,100 strong.

They’re part of what’s officially known as Nvidia’s Partner Network.

Although most companies in this group don’t see these kinds of gains …

These exceptional examples give an idea of the kind of impact working with Nvidia can have.

But, while Nvidia highlights their official partnerships with these companies on their website …

Something much bigger is going on behind the scenes.

You see, the real action isn’t in Nvidia’s “official” partners.

Today, I’m going to share a far more valuable list with you …

The “unauthorized” list of stocks working with Nvidia …

You won’t see their names on Nvidia’s Partner Network …

And very few TV talking heads have heard of them.

I call them Nvidia’s “Silent Partners.”

I believe this is where the real money lies in the near future of technology.

In fact, several companies in this unofficial network have already seen impressive returns since they began working with Nvidia. Here are some of the highest performers we’ve seen:

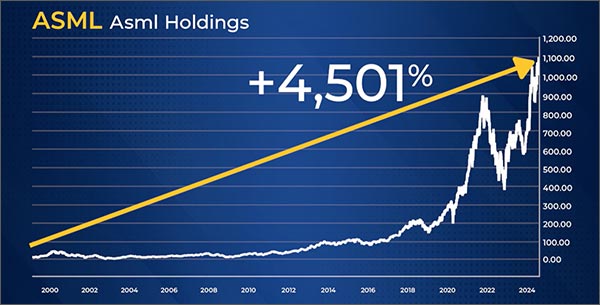

Take ASML, for instance.

This Dutch company has designed systems used to support the production of Nvidia’s chips since January 1999.

Since then, ASML’s shares have jumped 4,501%.

Few people are aware of the deep connection between these two companies …

Because Nvidia does not publicize it.

But folks like me, with long-time connections in Silicon Valley, know all about them.

Here’s another top performer …

Seagate Technology is one of the world’s largest data storage companies.

Back in 2004, they were one of the leading hard drive manufacturers around.

That’s when they first worked with Nvidia to drastically upgrade PCs, workstations and servers.

But it was never splashed across Nvidia’s website with a big announcement …

And most so-called experts never put two and two together.

Since Seagate first partnered with Nvidia …

Their stock has risen 1,938%.

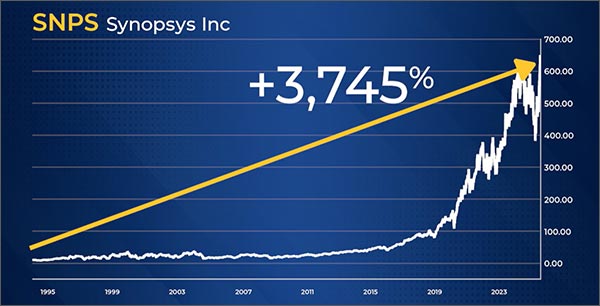

Synopsys is one of the worldwide leaders in electronic design automation (EDA) tools.

Nvidia depends on them to enhance the crucial chip design and verification process.

They’ve been collaborating for more than three decades — unofficially.

During that time, Synopsys has gone up 3,745%.

Taiwan Semiconductor is the world’s largest foundry.

That means they produce chips for AI, smartphones and all sorts of high-performance computing.

That’s crucial for Nvidia, which doesn’t manufacture their own chips.

Taiwan Semiconductor does that for them.

TSM’s stock has gone up 9,793% since they first started working with Nvidia back in 1998. Even though they’re not listed in Nvidia’s official Partner Network.

Broadcom’s a massive technology company known for designing chips and software powering everything from smartphones to data centers.

They’re actually considered one of Nvidia’s biggest competitors.

However, they’ve also collaborated for nearly two decades, since 2006.

That’s when they worked together to create a special chip for personal computers.

Since they became Silent Partners, Broadcom’s stock has skyrocketed 22,713%.

Now look, Nvidia’s Silent Partners don’t always see significant gains like this.

But returns like 4,501%, 1,938%, 3,745%, 9,793% and 22,713% offer a glimpse into the potential financial impact of working with Nvidia.

Now, bear in mind …

You’ll only learn the names of Nvidia’s three most promising Silent Partners in our own list.

In a moment, I’ll show you how to get your hands on this list.

I’ve sifted through dozens of these companies …

Using my contacts to uncover their connection with Nvidia.

And I’ve identified a few new Silent Partners that could be next in line to see significant gains.

These companies are where Nvidia’s future is headed …

They are involved with breakthrough technologies most Americans have never heard of …

And they are not listed on an authorized list by Nvidia.

You won’t find them in their official Partners Network.

Nvidia likes to keep the connection under wraps …

That’s why I’m calling them “Unauthorized” Silent Partners.

You see, Nvidia, as usual, is miles ahead of anyone else.

They never get nostalgic.

They don’t waste time patting themselves on the back for past accomplishments.

And their eyes are always squarely focused on the future …

On the next tech frontiers they intend to conquer.

That’s one of the many reasons why they are up 23,971% since I first called them.

Anyone who thinks they are still just a gaming chips and graphics cards company …

Just an AI chips company …

Or even just an AI data center company now …

Well, they’ve already been left behind.

Look, Nvidia isn’t waiting for anyone.

They’re pivoting to breakthrough industries predicted to be worth more than $24 trillion …

Right now!

And if Nvidia is spending big money here …

This is where investors are going to be.

Because this is where the next set of potentially massive returns may come from …

The future technologies very few investors have heard of — and even fewer are positioned to profit from.

My “Unauthorized” List of Nvidia’s Silent Partners includes the companies working on Nvidia’s future endeavors …

And I’m not talking about AI data centers.

Nvidia is aiming to be at the head of the table on a number of on-the-verge technologies.

And the Silent Partners on my unauthorized list are working closely with Nvidia on these breakthroughs …

Even though very few investors know it.

I Called Nvidia At 80 Cents & Bitcoin At $300

My name is Michael Robinson.

I’ve been at the forefront of these kinds of breakthrough technologies for over 40 years.

Both as an investigative journalist …

And as a special advisor.

Working with venture capital firms …

As well as a dozen different high-tech startup companies.

I was even nominated for a Pulitzer Prize for my work at the San Francisco Examiner.

That’s why I’ve consistently been able to spot the newest trends in tech …

Well ahead of Wall Street.

I did it with cloud computing …

You may have heard of it.

Fortune says it will be a more than $2 trillion industry by 2032.

Everyone’s getting into cloud computing now …

But I was in on that breakthrough technology before anyone else.

In fact, I was literally in the room when the term “cloud computing” was being coined …

Thanks to my deep connections …

I was able to see it coming way back in the early 2000s …

And using what I’d learned about it …

I was able to identify some of the very biggest winners in the sector.

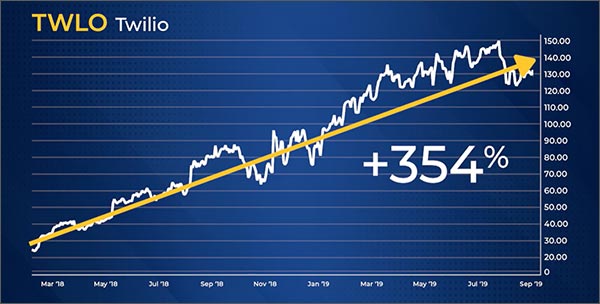

Like Twilio, which shot up 354% in less than two years.

And Veeva Systems, which climbed 372% in just over three years.

Even Square, a digital payment system that relies heavily on cloud computing …

Went up more than 560% in three years after I recommended it in 2016.

I was also in early on Nvidia …

Way back in 2016, when they were still flying under the radar.

Before AI shot them to the moon.

In fact, I recommended Nvidia to my followers …

When it was trading at just 80 cents a share.

The stock has soared 23,971% since.

I did the same thing with Bitcoin.

Alerting my followers to get in as soon as possible, way back in 2013 …

When it was trading for just $300.

It ultimately shot up 41,484% …

Now, I believe I’ve done it again.

I’ve uncovered two new, huge opportunities for investors.

Just like when I divulged Nvidia to my readers …

When it was trading for a mere 80 cents.

Or Bitcoin when it was a paltry $300.

These two tech trends have been some of my best calls to date.

But a select few of these new Silent Partner stocks will have a huge role in the newest tech trends.

And again, you won’t find them on their official list of partners.

Instead, I’ll show you how to get your hands on the unauthorized list of Nvidia’s three hottest new partners in a few moments.

These are the companies with a chance to truly explode …

Because these three firms are partnering with Nvidia to build the most advanced technologies in world history.

Potentially lucrative breakthroughs most laymen have never heard of.

Over $24 trillion is at stake, and Nvidia is in a race to be the first …

These Silent Partners hold the key to whether they pass or fail.

Nvidia’s Biggest Mistake

Nvidia CEO Jensen Huang built the world’s most valuable company from the ground up …

He’s now one of the richest people on the planet.

And thanks to his influence and popularity in the tech world …

He’s treated like a rock star wherever he goes …

Huang’s even been dubbed the “Godfather of AI.”

But when he took the stage at Nvidia’s annual GPU Tech Conference last March …

Also known as GTC, the “Super Bowl of AI” …

It wasn’t to take a bow.

Instead, he issued a mea culpa to the hundreds of thousands of investors, developers and analysts attending in person or online.

“This is the first event in history where a company CEO invites all of the guests to explain why he was wrong,” Huang said.

You see, in every generation, there’s a technological inflection point …

A moment when ideas long confined to the labs …

Suddenly become indispensable to the global industry.

For investors, those moments are rare and transformative.

Like the semiconductor wave of the 1980s …

The Internet in the 1990s …

Cloud in the 2010s …

And AI in the 2020s …

Now, the next decade is poised to belong to quantum computing.

But Huang didn’t see it that way at first …

In January, he said it could be 20 years before the technology was even useful …

But he and Nvidia quickly pivoted.

Huang apologized … and admitted his mistake.

And he’s put his money where his mouth is. Behind the scenes, Nvidia is quietly investing heavily into quantum computing.

You see, although it was previously disregarded as merely an academic curiosity …

Or science fiction …

Quantum computing is quickly emerging as a hardware race spanning governments, hyperscalers and startups worldwide.

Its promise is no longer theoretical …

Quantum computing isn’t coming “someday.”

It’s happening right now.

And it’s projected to impact and disrupt more than $100 trillion worth of technologies.

Many of the world’s most notable investors have gone all in …

Visionaries like Jeff Bezos and Bill Gates …

PayPal co-founder Peter Thiel and SoftBank CEO Masayoshi Son.

Ray Dalio, the founder of Bridgewater Associates …

Widely recognized as the world’s largest hedge fund …

Has grabbed a stake.

Even Warren Buffett, the Oracle of Omaha, has secretly gotten involved.

Many Fortune 100 companies have already lined up …

While growing government investments and emerging national quantum programs are accelerating adoption.

The U.S. is allocating billions in new funding …

China is reportedly spending $15 billion in a quest to dominate this breakthrough technology …

And countries like Japan and the U.K. are creating national programs pairing academia, startups and pivotal companies.

The Department of Energy, Boeing, BMW, NASA, Lockheed Martin and the National Science Foundation.

They’re all backing emerging companies in this sector.

And Nvidia, Microsoft, Google, Amazon, and Intel are injecting billions into hardware, software, and hybrid quantum-classical ecosystems.

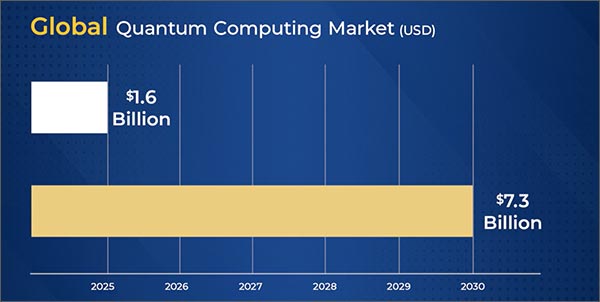

Over the last five years, the quantum computing market has nearly quadrupled.

But bear in mind …

This boom is just getting started.

Bank of America said,

“Whoever controls quantum computing

will control the world.”

Sundar Pichai, CEO of Alphabet, Google’s parent company, said,

“Quantum computing will be to AI what AI

has been to traditional computing.”

And Huang recently noted that,

“We are within reach of being able to

apply quantum computers in areas that

can solve some interesting problems in

the coming years.”

That’s why Nvidia is pivoting to this breakthrough technology.

They’ve already spent more than $100 million …

Investing in emerging quantum companies …

And developing their own open-source quantum platforms.

Nvidia made it crystal clear where their Midas touch is pivoting to next …

During their first-ever Quantum Day.

This was Nvidia’s public, official pivot into quantum.

They announced the creation of the Nvidia Accelerated Quantum Research Center.

This lab is set to open in Boston by the end of the year and will enable collaborations with pivotal quantum companies …

As well as leading universities such as Harvard and MIT …

They also opened a massive global research and development center in Taiwan in May …

It hosts the world’s largest supercomputer dedicated to quantum computing.

And Nvidia’s CUDA-Q and DGX systems have quickly become the backbone of hybrid quantum computing.

Many serious quantum firms want access.

The message is clear …

Nvidia is all-in on this technology.

Look, quantum computers are extremely complicated.

Especially when we start talking about terms like qubits, entanglement, decoherence and, my favorite, superposition.

Understanding how it works isn’t important …

What you need to know is quantum computers perform certain calculations exponentially faster than the fastest classical computers in use today.

To give you an idea of how incredible this technology is …

Google recently announced a new quantum chip called “Willow.”

Then gave it what amounted to an unsolvable mathematical problem.

It was so complex, the most powerful supercomputers available today would take 10 septillion years to solve it …

But it took a quantum computer under five minutes.

Although the age of quantum is still in the early innings.

A shift is taking place right now …

From the lab to real-world usage this year.

Look at these examples …

AstraZeneca is using quantum computing for drug target identification.

They’re simulating small molecules for cancer therapies.

This has the potential to shrink discovery timelines from months and even years down to just days.

UPS used quantum computing to optimize delivery routes for thousands of packages.

Cutting fuel costs and vehicle wear during trials.

The Mayo Clinic is partnering with a quantum company on a revolutionary medical device offering rapid diagnosis in cardiac care …

Potentially detecting heart attacks.

BASF, one of the largest chemical producers in the world, partnered with a quantum computing company to develop algorithms for weather modeling …

Supporting their agriculture division by enhancing their Digital Farming platform.

Lockheed Martin was able to test quantum navigation for GPS-denied environments.

And NASA optimized additive manufacturing processes for aerospace parts …

All by utilizing quantum computing.

These are not theoretical demonstrations concocted in a lab …

They’re real-world business applications.

The Quantum Insider is one of the world’s leading quantum technology publications.

It recently projected the quantum computing market could add more than $1 trillion to the global economy over the next decade.

And here’s the thing …

Right now, this market is incredibly small.

In fact, it’s currently valued at just $1.6 billion.

But it’s projected to grow nearly 600x over the next decade.

And I believe those numbers are extremely conservative …

That’s why Nvidia’s Quantum Day was much more than a symbolic move …

It was a strategic repositioning.

Nvidia wants to be the glue that defines the quantum computing era …

Moving forward, the same company that fueled the AI revolution with their GPUs …

Is going to build the infrastructure future quantum computers will depend on.

But Nvidia can’t do it alone.

That’s why they’re working with a vital network of tiny, specialized companies …

Together, they are constructing the quantum backbone to make this platform possible.

And two of them in particular are among Nvidia’s hottest new Silent Partners.

These two tiny quantum companies …

Which, combined, make up less than 1% of Nvidia’s market cap …

Are positioning themselves to become …

Along with Nvidia …

The leading architects of the quantum computing revolution.

NEW Silent Partner #1: The Precision Builder

The first company on my “Unauthorized” List of Nvidia’s Silent Partners has emerged as one of quantum computing’s first great pure plays.

They’re credited as a precision builder of quantum intelligence infrastructure.

Microsoft, Amazon and Google are already partnering with them.

BlackRock, Vanguard Group and Morgan Stanley have more than $32 trillion combined assets under management.

This company is listed on all of their portfolios.

They’ve already announced major collaborations with several U.S. government partners …

While also serving a diverse group of customers in the aerospace, automotive, pharma and energy sectors …

They’ve accrued 1,060 patents for their proprietary technologies.

But all those collaborations, milestones and patents …

Pale in comparison to their burgeoning partnership with Nvidia.

Thanks to this newfound alliance, Nvidia doesn’t have to build any state-of-the-art quantum hardware …

This Silent Partner takes care of that for them.

These components are essential for real-world applications …

And ensure Nvidia’s biggest strength, GPU acceleration, is applied effectively.

Although they are just getting started together, Nvidia and this new Silent Partner have already announced breakthrough results in pharmaceutical research.

Whether it's testing AI-quantum hybrid models …

Improving performance in optimization, simulation and machine learning tasks …

Influencing hardware-software standards …

Or reaching a broad base of quantum customers …

This Silent Partner is vital to Nvidia’s plans for dominating this sector.

NEW Silent Partner #2: The Hybrid Pioneer

The second company on my “Unauthorized” List of Nvidia’s Silent Partners is a quantum hybrid pioneer …

The likes of Amazon, Microsoft, Goldman Sachs and NASA back them …

Vanguard and Andreessen Horowitz are behind them as well, as is T. Rowe Price.

They’ve been selected by DARPA for national quantum testing …

And they were recently awarded a multiyear, multimillion-dollar contract with the U.S. Air Force Laboratory to advance superconducting quantum networking.

And unlike many firms in this sector …

They offer commercially available products right now.

Meaning they are ahead of the pack regarding early monetization opportunities.

They are also expected to be a key benefactor of JPMorgan Chase’s brand-new $1.5 trillion security and resilience initiative …

The nation’s largest bank just decided to begin a massive push into what they call frontier technologies … including quantum.

And all this momentum is getting supercharged by this firm’s blossoming partnership with Nvidia …

Look, these two Silent Partners won’t show up anywhere on Nvidia’s official Partner Network …

But now that quantum computing’s commercial phase has begun.

These companies are indispensable when it comes to meeting and even surpassing all of Nvidia’s quantum computing objectives.

Just like with AI …

Nvidia is angling to become the undisputed leader.

Which means Nvidia’s two quantum computing Silent Partners offer the rare opportunity to hold equity in the businesses engineering and ensuring that future.

I’ve prepared the important information you need to know about these transformative companies …

Including why they are the unquestioned leaders when it comes to this initial wave of the quantum computing boom.

But first …

Quantum computing is not the only breakthrough technology Nvidia is getting in on …

“A $24 Trillion Opportunity”

Huang and Nvidia have a habit of making industry-altering announcements at various showcases.

The Consumer Electronics Show in Las Vegas is no different.

It’s the world’s largest and most influential technology trade show.

That’s why Huang recently gave a keynote speech there.

When he walked on stage, you could’ve heard a pin drop.

The market hung on his every word.

That’s when he pulled the curtain back on another brand-new technology Nvidia expects to command …

Robots …

Robots — built by Nvidia.

Forbes says this could be “a $24 trillion opportunity for investors.”

Huang said, “The ChatGPT moment for robotics is right around the corner.”

In fact, I believe these particular robots could impact 65 million American lives — this year.

And one $5 stock …

The third company on my “Unauthorized” List of Nvidia’s Silent Partners …

Could be the biggest winner.

Robots are all the rage in tech right now.

And they just had a coming-out party in Las Vegas.

Everywhere you turned at CES …

A robot was there to greet you.

From robots that can clean your house and your pool …

Robots who do menial tasks in a factory or office setting …

There were robots that can make you a cup of coffee or a cocktail …

You could even create a robot with your smartphone.

Some looked so human … you may not have believed it was a robot.

Especially with how natural their reactions were.

Now, some of these humanoid robots are great for conversation and companionship …

But they are also benefiting society in more important ways.

Like Boston’s Dynamic Atlas — which is powered by Nvidia chips and appeared behind Huang at CES.

It can do backflips and bend down …

But it’s designed to take on hazardous conditions in search and rescue missions.

Going places where humans can’t.

Or Pepper.

Made by Softbank, it can carefully pick up and put down objects.

However, it’s capable of much, much more.

It can greet customers …

Collect health data …

It can even help senior citizens with daily tasks.

The lineup of robots on display at CES was incredible.

It truly was a sight to behold.

And proof that robots aren’t just coming.

They are here.

Right now.

Like I mentioned, Forbes called robots a $24 trillion opportunity for investors …

Adding that in 2025, robots will go “from being novelties to being essential.”

Oxford Economics says, “The Robotics Revolution we predicted has arrived.”

It’s not surprising, all things considered.

The global robotics market is experiencing rapid growth.

It’s more than quadrupled over the past five years.

Now, thanks to rapid advances in artificial intelligence …

Robots are standing on the edge of history …

Where Nvidia wants to be right now.

And just like with quantum computing …

They’ve been working diligently behind the scenes to master this industry.

Some of the companies partnering with them on robots have already benefited.

Let’s look at some of the robotics stocks that have performed the best.

BYD Electronics is heavily involved with both humanoid robots and industrial automation.

They first adopted Nvidia’s robotics platform to develop autonomous mobile robots (AMRs) for factory automation last year.

Since BYD Electronics first started working with Nvidia in March 2022 …

Their stock more than tripled in less than three years.

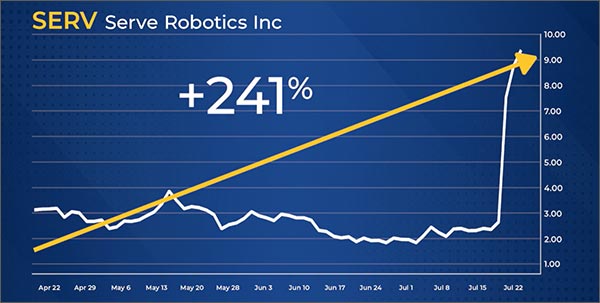

Serve Robotics specializes in AI-powered sidewalk delivery robots.

Their collaboration with Nvidia has enhanced their AI-driven navigation and operational efficiency.

After Nvidia took a $4 million stake in the company in 2024 …

Serve Robotics went up 241% in three months.

And Richtech Robotics builds robots specifically for service industries …

Including bartending, patient monitoring and medication delivery.

They utilize Nvidia’s Jetson platform for real-time AI processing in their robots.

After Richtech announced that its beverage-service robot, Scorpion, leverages Nvidia AI technologies in September 2024 …

Its stock went up 667% in just over a year.

This is the kind of impact Nvidia has already had on the industry.

That’s why, in Las Vegas, Huang did more than just talk.

He laid out the vision for building the world’s first trillion-dollar robot.

While also explaining how a specific $5 stock is so important to that goal.

I fully expect Huang’s plan will be ready to go mainstream …

By the end of this year …

But for that to become a reality …

Nvidia needs the help of one $5 company …

That’s why they’re the third company on my “Unauthorized” List of Nvidia’s Silent Partners.

And the most surprising part …

This trillion-dollar robot …

Is not a humanoid robot like the ones that were standing behind Huang at CES.

It won’t be able to make you a drink … or clean your house.

Honestly, it may never even go inside your home.

And it won’t go in a factory either …

In fact, the trillion-dollar industry Nvidia plans to take over with the help of this $5 stock is not what you think …

But it is going to help plenty of Americans just like you.

It will add nearly 10 million jobs to the workforce.

NEW Silent Partner #3: The $5 Key Unlocking the Newest Sector of Robotics

Huang says it could be, “the largest technology industry the world has ever seen.”

Microsoft’s Bill Gates said, “it will be as revolutionary as the PC.”

I expect this trillion-dollar robot to reach over 65 million American homes before this year is out.

Some of the biggest financial players see what’s on the horizon.

And are rushing to get in on this groundbreaking robot.

The top three venture capital firms in the world — Tiger Global Management, Sequoia Capital and Andreessen Horowitz — are fully on board.

Tiger and Sequoia combined to invest nearly $250 million in this project.

Andreessen Horowitz has also participated in more than ten different rounds of funding towards this project …

Worth more than $5 billion.

Remember, these same firms were amongst the first to pour money into AI.

Sequoia Capital first invested in Nvidia back in 1993.

In fact, they were amongst the earliest investors in Google and Apple …

Tiger Global invested $125 million into Open AI late in 2021 …

A year later, ChatGPT took the world by storm.

In 2023 alone, Tiger invested over $1 billion in Nvidia …

Starting when they were trading for less than $15 a share.

Andreessen Horowitz was amongst the earliest investors in Facebook and OpenAI.

So, while the concept of robots in our daily lives may seem far off …

It would be foolish to think that these venture capital powerhouses aren’t in the know.

Nonetheless …

It’s not just VC firms that see the writing on the wall.

Financial giants like Fidelity and T. Rowe Price have also poured in millions.

Including a $125 million investment into the $5 stock critical to what Nvidia is building …

This unique robot is so important that some of the biggest names in tech …

Like Amazon …

Tesla …

Microsoft …

Google …

They have spent tens of billions of dollars on it …

Each.

All in a desperate effort to get ahead.

But just like the battle to dominate AI …

And the newfound quest to corral quantum computing …

Nvidia has quickly emerged as a clear front-runner to win this race …

There’s just one problem …

You see, there is one thing Nvidia can’t do …

And they need the technology of this virtually unknown $5 stock to finish the job.

They are head and shoulders above anyone else in their area of expertise.

Index Ventures, one of the biggest VC firms in the world, called them,

“The best technologists in the business.”

Backing it up with a $90 million investment.

Amazon’s Jeff Bezos owns a big stake in them as well.

And their network is growing rapidly.

In addition to Nvidia …

They’ve formed partnerships with the likes of FedEx …

Volvo …

Toyota …

The list goes on.

All clamoring to use their proprietary software.

Because it’s already passed the test with flying colors.

They already have almost 100 active patents involving their distinct, proprietary tech.

And they also just built a state-of-the art facility in Montana to continue developing and testing it.

Huang has famously said, “We have to solve problems no one else has solved and develop tech that doesn’t exist today.”

That’s exactly what Nvidia and their $5 stock partner are doing.

With Nvidia providing the AI support needed to make all systems go …

This small company …

Less than 1/100th the size of Nvidia …

Could be about to soar …

This is potentially a massive boost for the American people …

The economy …

And particularly for investors.

I’ve put together all the details on this third “Unauthorized” Nvidia Silent Partner for you …

Including why they are perfectly positioned for this emerging new sector of robotics …

As well as everything you need to know about the two companies spearheading quantum computing’s rise …

In fact, you’ll get all my expert research on each of these three revolutionary companies in my new special report, Nvidia’s Top 3 “Unauthorized” Silent Partners.

Inside, I’ll show you why each of them is poised to break out …

But before I do …

There’s something else I want to share with you.

2 Additional Unauthorized Silent Partners

Yes, Nvidia is making aggressive moves to become the undisputed leader in both quantum computing and robotics.

And I believe it would be a mistake to ignore these multitrillion-dollar pivots …

But Nvidia isn’t through with AI …

Not by a long shot.

Especially AI data centers.

And why would they be?

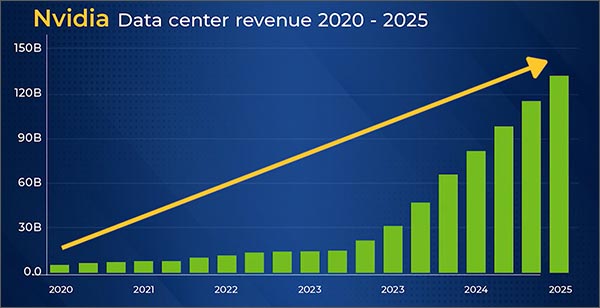

Nvidia’s data center revenue has jumped nearly 2,200% in the past five years.

Spending has reached unprecedented levels, with total investments approaching $400 million globally this year.

And McKinsey is projecting another $6.7 trillion to be spent worldwide on new AI data centers through 2030.

That includes Meta’s just-announced $1.5 billion AI-optimized facility in El Paso, Texas …

Which will be powered by Nvidia’s systems.

As well as a $40 billion deal completed by the AI Infrastructure Partnership …

That’s a collaboration between Nvidia, BlackRock, Microsoft and MGX …

To acquire Aligned Data Centers …

Expanding the partnership’s portfolio to nearly 80 facilities.

While Nvidia will continue pivoting to the latest revolutionary new technologies …

They also plan to dominate existing ones as well.

That’s why my “Unauthorized” List of Nvidia’s Silent Partners includes two additional potential superstars.

They are vital to Nvidia’s continued data center dominance …

As well as a prime opportunity for investors.

I’ve identified two companies whose stocks have breakout potential thanks to their integral partnerships with Nvidia in the coming waves of AI data centers.

They could be at the forefront of explosive AI growth in 2026 and beyond.

They include:

- An emerging powerhouse that produces components serving as the backbone of network infrastructure. They specialize in the production of critical routers and switches necessary for AI data centers, a market that is growing rapidly.

And …

- A major supplier to technology juggernauts such as Apple and Tesla now charged with producing essential components that will enable AI data centers to function properly.

These companies, combined, are also just a fraction of the size of Nvidia.

But as their work on AI data centers quickly becomes well-known,

their stocks have the chance to take off.

I’ll send you the names and ticker symbols for these stocks as well …

And show you how and when to take a position on them …

In my latest briefing, Nvidia’s 2 “Unauthorized” Silent Partners Powering the Data Center Explosion.

I’m prepared to rush this report …

As well as Nvidia’s Top 3 “Unauthorized” Silent Partners.

To your inbox right away.

All I ask is that you give my monthly newsletter, Disruptors & Dominators, a risk-free try.

120 Different Triple-Digit Winners

I’ve spent more than 40 years as a Silicon Valley insider.

And while working with and consulting for some of the biggest names in the industry …

I’ve been at the forefront of several breakthrough technologies …

Including Bitcoin, gene editing and 3D printing.

I was in the room when the term “Cloud Computing” was being introduced.

And I was all-in on AI well before anyone had even heard of ChatGPT.

My insider access …

Earned through four decades of diligent, award-winning investigative journalism …

As well as my time on the advisory board of a venture capital firm and as an advisor to 12 high-tech startups in Silicon Valley …

Has allowed me to see massive market moves coming before the rest of the crowd.

My comprehensive industry knowledge allows me to take deep dives into disruptive technologies the public has heard little about …

I was nominated for a Pulitzer Prize while with the San Francisco Examiner.

My work has been featured in both The Wall Street Journal and the New York Times.

And I’ve appeared on Fox Business, Bloomberg and CNBC.

And my industry insights have enabled me to make some incredible calls in the process …

Like Nvidia at 80 cents in 2016 …

And Bitcoin at $300 even further back in 2013.

Over the past decade plus, I’ve given my readers the chance to make a long series of significant gains.

In fact, they’ve had 120 different chances to score triple-digit returns …

Including some truly remarkable winners.

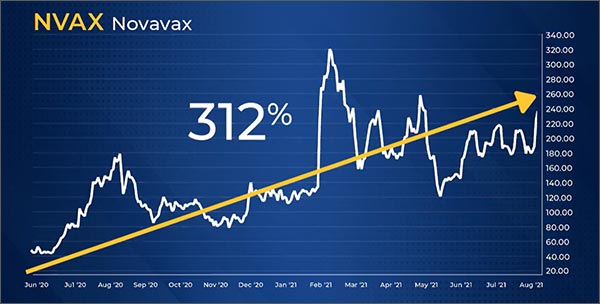

Like when I nailed a 312% win on Novavax in just over a year …

Or 345% on Shopify in just under two and a half years …

Truth be told …

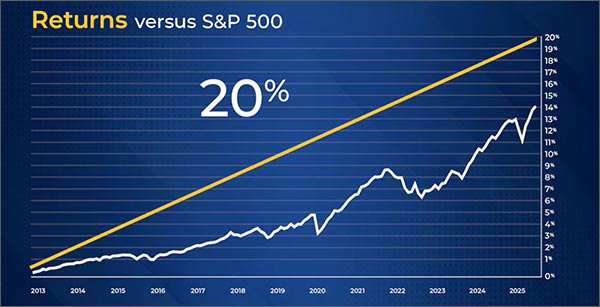

Since 2013 …

The average gain for all of my picks was 20% …

That includes both the winners AND the losers.

That beats the S&P’s average over the same time period.

Of course, nothing is ever guaranteed in the market.

You should never invest more than you are willing to lose.

It’s this wealth of diverse experience that produces the in-depth insight and performance you’ll get when you subscribe to Disruptors & Dominators.

Everything you need to know about the latest and greatest in the world of tech …

Including when I believe these disruptive technologies are poised to become a part of our daily lives …

All delivered directly to your inbox on the first Friday of every month.

You’ll get the latest updates as they happen …

And the important alerts you need for the best chance to take advantage of the market.

It’s the same blueprint I’ve used to score some of my biggest winners …

Like 23,971% on Nvidia …

And 41,484% on Bitcoin.

However, when you join Disruptors & Dominators, you get something even more special.

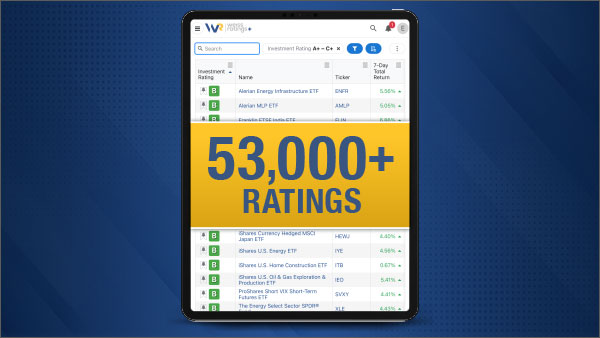

I’ve combined my stock expertise with the nearly 55-year track record of Weiss Ratings.

That’s the #1 stock rating system in the financial world.

And that’s according to The Wall Street Journal.

Investors who used Weiss Ratings …

Could have made more money than any other financial firm they reviewed.

Including some of the biggest, most well-known names in the industry.

Including Deutsche Bank …

Merrill Lynch …

Morgan Stanley …

JPMorgan Chase …

Goldman Sachs …

All surpassed by the mighty Weiss Ratings …

And a study commissioned by the Securities and Exchange Commission and others agrees.

The study investigated which financial ratings company had the best profit track record for stocks.

Weiss Ratings came out on top again.

It’s simple …

Weiss Ratings is a completely independent, truly unbiased ratings company.

We never accept a dime from the companies or issuers we rate.

We never have …

And we never will …

Since we started this business nearly 55 years ago …

Our goal has been to give regular Americans the critical information they need …

To not only keep up with Wall Street …

But to beat it.

Weiss Ratings evaluates more than 53,000 different stocks, ETFs and Mutual Funds.

Over the past 20+ years …

Weiss Ratings has issued “Buy,” “Sell” and “Hold” ratings to more than 12,500 stocks.

The average gain on every single “Buy”-rated stock has been 305%.

Including the losers.

I have a history of finding exceptional gems in the market.

Long before others.

Weiss Ratings has an extensive history of this as well.

Here are a few of Weiss’ winners over the years …

Tyler Technologies has created essential technology for many Microsoft products, like Dynamics 365, for years …

The cloud company also partnered with Amazon Web Services in 2019.

But Weiss Ratings first signaled Tyler Technologies as a “Buy” way back in 2003.

It’s shot up 16,661% in just over 22 years.

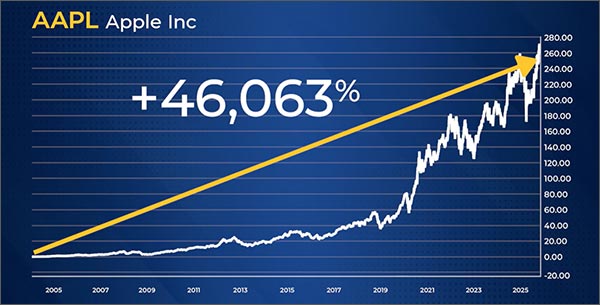

And how about Apple?

Weiss Ratings rated them as a “Buy” back in 2004.

Three years before the iPhone came out …

They’ve since shot up 46,063%.

And then there’s Nvidia …

Today, they’re a household name.

But when our Weiss Ratings recommended them in 2011, they were still a small tech company known primarily for their video game chips.

But, behind the scenes, Nvidia actually had a lucrative silent partnership with Microsoft.

You can probably guess what happened next …

Shares of Nvidia are up 43,786%.

These are a few examples of the more than 400 different Weiss Ratings recommendations that resulted in gains of 1,000% or better.

Nvidia is paying it forward by helping send their own Silent Partner stocks soaring.

Now, I think I’ve found five more that have the chance to do the same.

And the best part is …

All the investments we make in Disruptors & Dominators are backed by these Weiss ratings.

It’s one of the many benefits you get when you subscribe.

To recap …

When you take a chance on Disruptors & Dominators, you’ll get the following benefits:

- 12 Monthly Issues. On the first Friday of every month, you’ll get a new issue full of my latest research on what’s happening in tech, along with a fresh recommendation for the sector’s next hot name.

- ASAP Alerts and Updates. Any time the market swings or something changes with one of my recommendations, you’ll be the first to know. We’ll send critical alerts to help you stay ahead of the market.

- Full Access to the entire Disruptors & Dominators catalog. You’ll be privy to any and every issue, alert and special report we’ve ever published on a number of different topics in tech.

- Free subscription to Weiss Ratings Daily. Keep up with the everyday movements of the overall market with our expert analysis. All of our analysts contribute to bring you the latest news and updates from around the financial world.

- Free Copy of the User’s Guide to Disruptors & Dominators. A comprehensive review of everything you need to know about the service … and how to get the absolute maximum out of your subscription.

On top of that, I’ll send you two valuable special reports right away.

- Report #1: Nvidia’s Top 3 “Unauthorized” Silent Partners. The world’s most valuable company is pivoting to two breakthrough industries projected to be worth more than $24 trillion. However, they desperately need three under-the-radar silent partners to make these pivots a smashing success.

- Report # 2: Nvidia’s 2 “Unauthorized” Silent Partners Powering the Data Center Explosion. Although Nvidia is gearing up for quantum computing and robotics, they also plan on controlling the AI data center market for the foreseeable future. These two additional “Unauthorized” Silent Partners will need to play a vital role for that to happen.

I’ll get your information in a minute so I can have these reports in your inbox in a matter of moments …

With the names of five promising “Unauthorized” Nvidia Silent Partner stocks.

But first …

Although I’ve put the spotlight on my “Unauthorized” Nvidia Silent Partner list …

There are three companies in Nvidia’s Official Partner Network I want you to know about today as well.

BONUS: Nvidia’s Top Official Partner Stocks

I believe the five “Unauthorized” Nvidia Silent Partners I have talked about today are all well-positioned in three technology sectors poised to skyrocket in the coming years.

But they’re not the only ones …

Like I said earlier, Nvidia’s official Partner Network features nearly 1,100 companies.

Many of them are private companies and thus unavailable …

And not all of them are going to pan out …

But as you saw with those earlier “Official” Partner stock gains I highlighted …

Including some big winners like 712%, 1,267% and 1,385% …

There are seemingly unlimited possibilities when it comes to partnering with Nvidia.

And I’ve found three companies in their network I believe are in favorable situations right now.

- OFFICIAL PARTNER STOCK #1 has already aggressively carved out a lucrative niche in the data center market. That’s because this is one of the only companies able to provide Nvidia with the specific support they need to keep AI data centers humming.

- OFFICIAL PARTNER STOCK #2 has worked behind the scenes with Nvidia since 2022, and the partnership is paying off as these two tech giants are accelerating the quantum computing timeline and making it viable for commercial use much quicker than expected.

- OFFICIAL PARTNER STOCK #3 is one of Nvidia’s newest official partners and is making a critical pivot into AI infrastructure. They’re leveraging Nvidia’s hardware for hyperscale cloud computing, while Nvidia gets to test their own latest GPU technologies in ideal testing settings.

Nvidia could have each of these official partners soaring in the near future.

I’ll tell you exactly what you need to know in an exclusive bonus report titled Nvidia’s Top 3 “Official” Partners for 2026.

When you join us at Disruptors & Dominators, you’ll also get …

Nvidia’s Top 3 “Unauthorized” Silent Partners …

And Nvidia’s 2 “Unauthorized” Silent Partners Powering the Data Center Explosion …

But that’s not all …

You’ll also get 12 monthly issues of Disruptors & Dominators.

Full of executive-quality research on the exciting world of tech investing.

Backed by my 40-plus years of Silicon Valley expertise …

As well as the world’s #1-ranked stock system.

I’ll also send out urgent market alerts and updates …

As they happen.

So, you can always stay ahead of the market.

If you aren’t satisfied at any time for any reason during your first 12 months.

Just call our Member Care Team and they’ll be happy to give you a full refund …

Right up to the very last day of your membership.

No questions asked.

You can keep every issue, every bonus report and every alert you’ve received.

Today, as part of your “risk-free” membership with Disruptors & Dominators, you will receive seven comprehensive, immediately actionable benefits:

- BENEFIT #1 A full 12 months of access to Disruptors & Dominators (sold separately for $129).

- BENEFIT #2 Nvidia’s Top 3 “Unauthorized” Silent Partners (sold separately for $79).

- BENEFIT #3 Nvidia’s 2 “Unauthorized” Silent Partners Powering the Data Center Explosion (sold separately for $79).

- BENEFIT #4 Nvidia’s Top 3 “Official” Partners for 2026. (sold separately for $79).

- BENEFIT #5 The User's Guide to Disruptors & Dominators. I'll explain my unique investing philosophy and how to use it to maximize your profits.

- BENEFIT #6 My flash alerts for critical, time-sensitive opportunities and warnings (invaluable).

- BENEFIT #7 My Unconditional 100% Money-Back Guarantee.

One year of Disruptors & Dominators normally retails for $129.

And that’s what thousands of our subscribers have paid.

But with Nvidia aggressively pivoting into both quantum computing and robotics …

Even though we are still in the early innings of two breakthrough technologies.

I want you to get a chance to get in on the ground floor.

So, I want to make you a special offer …

You will get a full year of access to everything I just mentioned.

For just $49.

That's 62% off the suggested retail price.

I think you'll agree it's more than fair.

Especially with Nvidia’s expected impact on two fast-emerging revolutionary technologies …

As well as their continued dominance in AI data centers.

And all the benefits it could bring to investors.

With the eight total stocks I'll share with you today …

You'll have what I think is the very best chance to capitalize on these powerful transformations in society.

Nvidia’s next moves are right here!

At any moment, these companies I’ve shared could become front-page news.

So, don’t wait.

Click the button below to join Disruptors & Dominators and get immediate access to these six disruptive companies.

I’m Michael Robinson.

Thank you so much for joining me.