Major DOGE AI announcement could save taxpayers billions of dollars — and drive up the price of six specific stocks.

Elon Musk’s Next Big Win

Silicon Valley legend Michael Robinson called Nvidia at 80 cents and Bitcoin at $300. Here’s his 2025 AI investing blueprint.

Dear Reader,

Elon Musk and his Department of Government Efficiency (DOGE) have already done more to change our government in a month than most do in a decade.

Literally taking a chainsaw to bureaucracy and government waste.

That’s why President Trump is so proud — and supportive — of Elon.

And it’s why you should stay alert for DOGE’s next move.

Expect an announcement from Elon any day now …

Thousands of government jobs could be replaced …

By a new form of AI.

Recently perfected by Musk and his team at xAI, as well as most of the Magnificent 7 companies.

This one move by DOGE could save American taxpayers billions of dollars.

But even more important to you as an investor …

It could light a fire under the AI market.

And six specific stocks could soar as a result.

No, I’m not talking about Nvidia.

But instead, a handful of companies critical to its operations.

These companies are silent partners of Nvidia — as well as almost all the Magnificent 7.

Silicon Valley legend Michael Robinson …

One of the most respected tech investors out there …

The man who called Nvidia at 80 cents and Bitcoin at $300 …

Just released his 2025 AI investing blueprint.

And he says these six stocks will play a major role.

So please pay attention to what Michael has to say. You’ll want to act quickly.

Before Musk and DOGE’s big announcement potentially spikes these stocks out of reach.

Here’s Michael Robinson with more details behind his 2025 AI Blueprint.

I’m Michael Robinson.

And if you thought 2024 was an incredible year for AI …

You haven’t seen anything yet.

That’s because, with Donald Trump back in the White House …

And with Elon Musk, one of the world’s most powerful men, by his side …

The market has taken off.

I believe 2025 could blow everything before it out of the water when it comes to artificial intelligence.

Now, everybody wants to know which AI stocks could skyrocket next.

That’s why I’m revealing my 2025 AI Blueprint right here in this video.

You see, my research tells me some of the best investments in AI right now involve the companies that work with Nvidia.

These companies may not be front page news …

In fact, they may be under-the-radar for most investors.

That’s why I call them Nvidia’s “Silent Partners.”

But they have been absolutely vital to Nvidia’s exponential growth.

Not to mention a major reason the AI leader is now one of the most valuable companies in the world.

Look at the growth of these select companies that have partnered with Nvidia.

Take ASML, which works closely with Nvidia on its chips.

ASML’s shares have gone up as much as 500% since 2019.

Or look at Applied Materials, which helps Nvidia with a specific part of its chips called the wafer fabrication component.

Its stock has gone up as high as 562% in a little over 5 years.

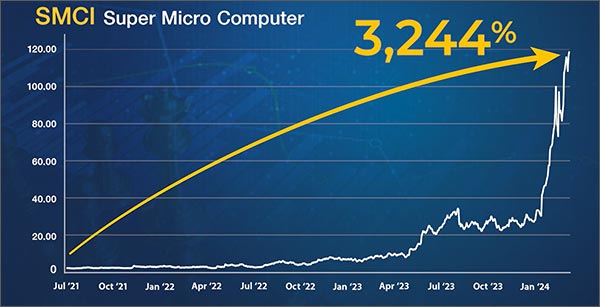

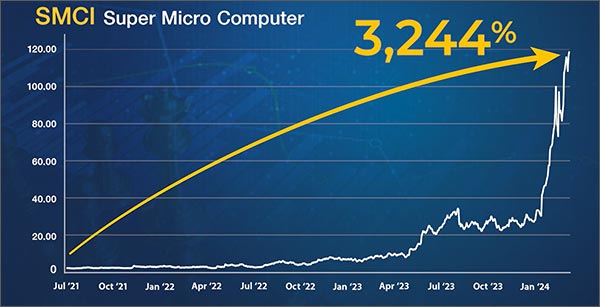

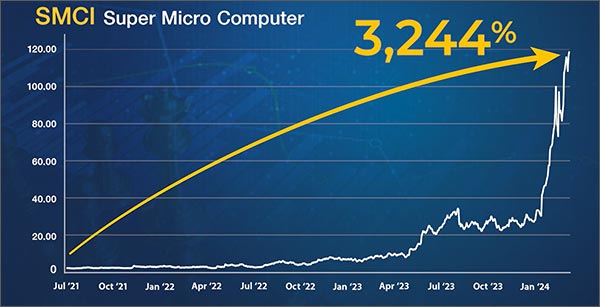

If you think that’s good, take a look at Super Micro Computer, which has partnered with Nvidia for over a decade …

Its stock has surged as much as 3,244% over the past three years.

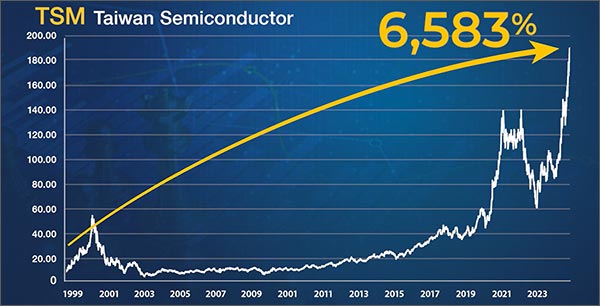

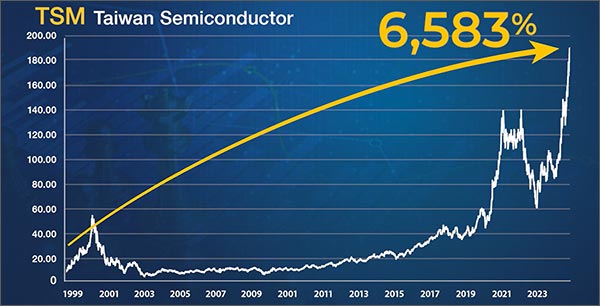

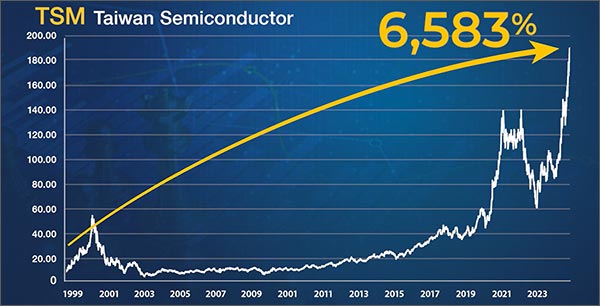

And then there’s Taiwan Semiconductor (TSM), the world’s largest chipmaker.

Nvidia depends on TSM daily. Why?

Well, it doesn’t manufacture its own chips. TSM produces the majority of them.

And TSM’s stock has exploded as much as 6,583% since first partnering with Nvidia in 1998.

But here’s the thing …

I’m not telling anyone to buy those companies today.

My 2025 AI Blueprint does not include any of them.

That’s because Nvidia is making a $1 trillion pivot to another sector of the AI market.

And now I’ve found a few new silent partner companies who could play a major role in 2025.

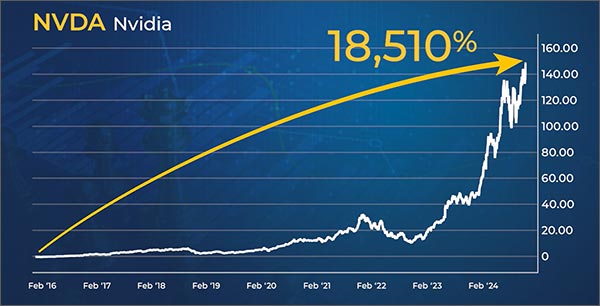

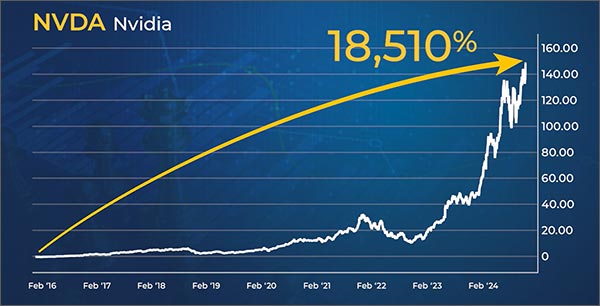

Look, I was way ahead of the AI curve, picking Nvidia at a split-adjusted 80 cents back in 2016.

The stock has gained 18,510% since then.

I did the same thing with the cloud computing industry that’s on pace to be worth $3 trillion in economic value …

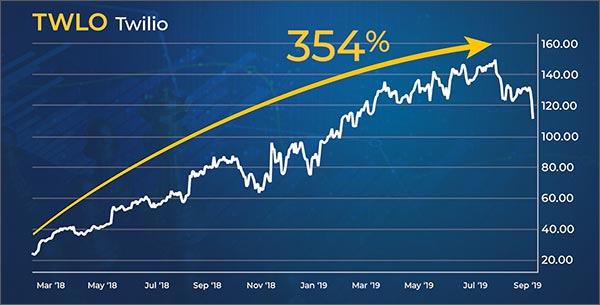

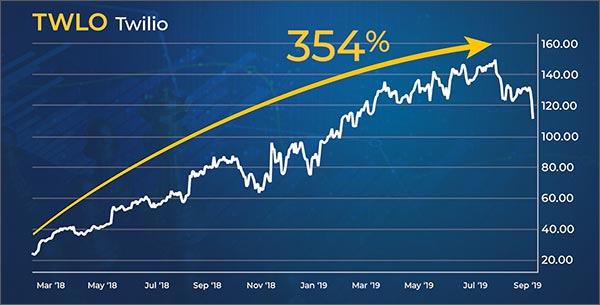

I called Twilio, a pioneer in that sector, for a 354% gain in just two years.

And Veeva Systems for a 372% gain in a little over three years.

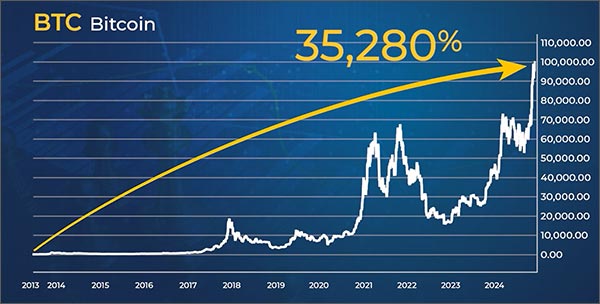

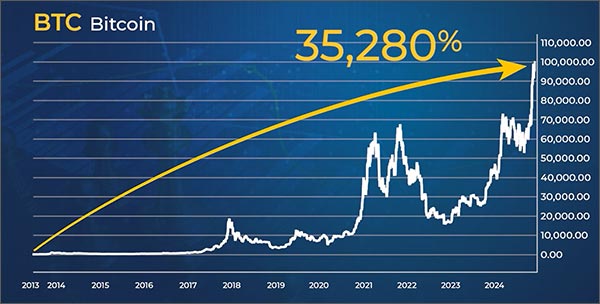

And I was in early on digital currency, recommending Bitcoin at $300 in 2013.

It’s surged as much as 35,280% since.

In fact, for the past 11 years, from 2013-2024 …

The average gain for each and every one of my picks has surpassed the S&P 500’s 15% average annual gains during the same period …

And that includes all my winners and losers.

Now, I’m here to say, if we stay in the same old AI stocks, we might make some money …

Because the AI market is still expected to soar this year …

But my research tells me the best investment opportunities in 2025 are different than those in 2024.

Elon Musk is “Begging” for This

And it all has to do with Nvidia’s latest invention — the Blackwell chip.

Look, Nvidia’s existing AI chips are already the backbone of the AI boom.

But the revolutionary Blackwell chip looks like it’s going to destroy everything that came before it.

It’s now the most powerful chip in the world.

At least twice as fast as Nvidia’s previous AI chips …

With 5X the AI performance …

The Blackwell chip will be the “engine to power this new industrial revolution.”

- Jensen Huang

CEO, Nvidia

Right now, the number of requests for it is already off the charts.

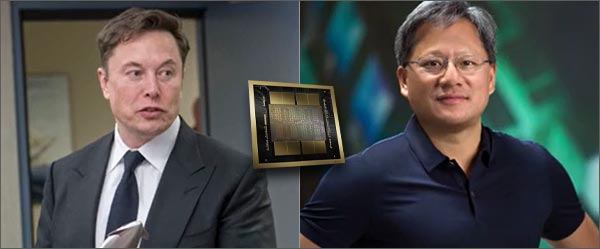

For example, take Elon Musk, the richest person in the world who’s also now Trump’s right-hand man.

He’s one of the most powerful people on the planet.

Have you ever heard of him begging for anything?

Well, that’s just what happened recently.

While dining with Huang at Nobu in California …

There was Musk, pleading for more of Nvidia’s new chips …

Begging to spend more money with Nvidia …

And it’s not just Musk …

Other tech CEO giants — that includes Mark Zuckerberg, Jeff Bezos and Sam Altman — are scrambling to get as many of these chips as they can.

I’m talking millions right out of the gate.

And now, on top of that, Huang has just made a critical $1 trillion pivot.

You see, even though Nvidia’s stock has already risen 780% since the start of the AI boom near the end of 2022 …

Even though it grew rapidly to become one of the most valuable companies in the world …

Even though, right now, Nvidia IS AI …

It’s not standing pat.

No, with this critical pivot, Nvidia is now aiming to conquer an emerging new sector of artificial intelligence …

And further dominate the AI frontier, potentially, for years to come.

It all has to do with the sudden rise of AI data centers.

It’s simple …

Artificial intelligence requires massive amounts of data every day.

This is why Forbes, and many others regard data as “the new gold.”

In fact, if we could gather up all the data in the entire world and take a close look at it, we’d discover something totally mind-blowing …

We’d see that 90% of all the data was generated just in the last two years alone.

It’s true … and it continues to grow.

AI-generated data is expected to increase more than 50% again …

In just the next two years.

And all that data needs to be processed somewhere. It doesn’t just evaporate into thin air.

That’s where AI data centers come in …

Raw data comes into these buildings, is refined and intelligence goes out.

It’s this comprehensive process that enables AI to keep growing exponentially.

To keep up with AI’s dramatic growth, thousands of data centers are desperately needed.

Not next month …

Not tomorrow …

Right now.

AI cannot exist without them.

That’s why, over the next three years, an AI-driven construction boom is expected to take place all across the country.

Data centers are projected to multiply sixfold.

That includes places like Council Bluffs, Iowa, across the border from Nebraska.

That’s where Google has committed over $5 billion to a new data center occupying more than 2.5 million square feet.

And it’s not the only Big Tech giant involved …

Meta is investing billions in a data center more than 5 million square feet in size.

Now, you might be wondering how big is that?

Well, imagine the flight deck of a giant aircraft carrier …

Then imagine 275 of them lined up side by side.

That’s how big these data centers need to be nowadays …

Microsoft and OpenAI have even combined forces on a $100 billion data center giant codenamed Stargate.

And Amazon has committed to invest more than $100 billion in data centers.

Musk himself is taking part as well …

That’s why he was begging Huang for more Blackwell chips …

His artificial intelligence startup, xAI, is quickly doubling the size of its immense supercomputer, called Colossus.

Nvidia: $5 Trillion by the End of 2025

Look, this is no secret.

Thousands of new data centers are coming right now.

Experts predict the market for them is projected to jump over an estimated 2,000% over the next decade …

That’s why Huang recently said that Big Tech needs to spend over $1 trillion on data centers in the next couple of years.

And guess what’s going to be in most of them.

You got it. Nvidia’s Blackwell chips.

You see, Nvidia is in such a unique place right now.

All the big AI companies — Amazon, Meta, Microsoft and Google — all rely on Nvidia.

This pivot to data centers has the chance to redefine the company’s mission.

Nvidia’s gone all-in …

Recently, the company mentioned data centers no less than 56 times during an earnings call.

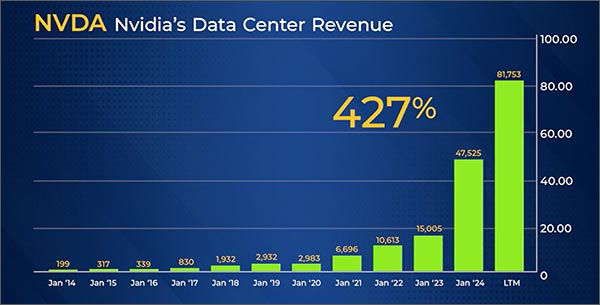

And take a look at this.

In the past year alone, Nvidia’s data center revenues have exploded 427%.

You see, Nvidia is already one of the most valuable companies in the world …

But many believe this monumental move could make it worth as much as $5 trillion …

By the end of 2025.

This is the future of AI.

The whirlwind growth of artificial intelligence is expected to drive continued demand for data centers into the next decade and beyond.

That’s why they are the key to my 2025 AI Blueprint.

And here’s the thing …

Just like with its chips …

When it comes to the thousands of new data centers rapidly being built …

Nvidia can’t do everything by itself.

It needs to rely on the help of a small handful of silent partners.

And with Big Tech expected to shell out more than $1 trillion on data centers over the next few years …

Those companies partnering with Nvidia could be the next big stars of the AI boom.

That’s why I’m here today …

Nvidia is AI’s darling.

Some of its more successful silent partners have already surged …

Like ASML, which has been up as much as 500% …

Applied Materials, up as much as 562% …

SMCI, which has climbed as much as 3,244%.

And Taiwan Semiconductor, which has soared as much as 6,583%.

They’ve all played crucial roles in Nvidia’s continued AI chip dominance.

There’s no doubt about it.

But bear in mind, my 2025 AI Blueprint does not include any of those companies.

No, as Nvidia moves to dominate the data center market …

Armed with its one-of-a-kind Blackwell chip …

Nvidia’s now quietly leaning on a NEW set of silent partners.

What’s more, within that small, elite group of companies, there are three I’m going to introduce today.

You see, everyone’s been talking about Nvidia, AI’s golden goose …

But practically nobody is talking about these silent partners.

Based on my analysis, these select few are what investors should be looking for.

Very few people know who these companies are …

Even some of the savviest investors I know aren’t aware of them.

Or how big a role they could play in Nvidia’s pivot to AI data centers.

But I do …

284% average gain on each and every trade, including the losers, over 20 years

Because my firm has a history of finding the best tech stocks.

As I mentioned earlier, my name is Michael Robinson.

I’m the Director of Tech Investing at Weiss Ratings.

From day one, more than 53 years ago, our goal has been to give regular Americans the insights they need …

Not just to keep up or even beat the best on Wall Street …

But to do even better.

Consider this …

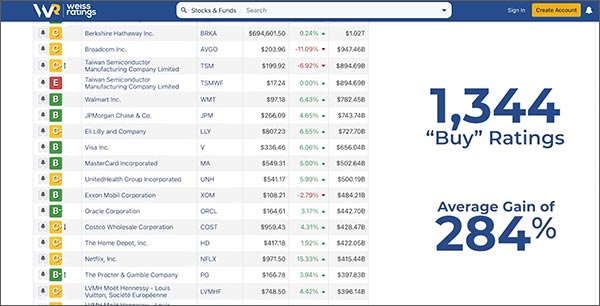

Weiss Ratings gives “Buy,” “Sell” and “Hold” ratings to about 12,500 stocks, and they’ve been doing it for decades.

Over the last 20 years, the average gain on our tech stock “Buy” calls has been 284%.

Including laggards. Including losers.

That’s almost a 4-fold gain on each and every one of our 1,344 “Buy” ratings!

That’s why The Wall Street Journal reported that our ratings ranked number one, over everyone else covered, including wealth management giants like:

- Merrill Lynch

- Deutsche Bank

- JPMorgan

- Goldman Sachs and

- Morgan Stanley

Institutions that have millions of customers …

And manage trillions of dollars …

Weiss Ratings beat their ratings hands down.

Why? It’s because Weiss Ratings is a completely independent, truly unbiased ratings company.

And it has offered some of the best ratings of any publicly known trading system.

That’s not just me saying it …

You see, when the U.S. Securities and Exchange Commission, the SEC, sponsored a study to determine which independent research organization had the most accurate stock track record …

Weiss Ratings didn’t just come up in the top 10 … top 5 … or top 3 …

They were NUMBER ONE — overall.

That’s one of the biggest reasons why I joined forces with them.

We not only rate over 12,500 stocks, but also ETFs, mutual funds, banks and insurance companies.

And unlike our big Wall Street competitors, we never accept a dime from the companies or issuers we rate.

We never have and we never will.

Again, each and every one of our 1,344 Weiss tech stock “Buy” signals over the past two decades has gone up an average of 284%.

And over that time, some of the biggest winners among our “Buy”-rated companies involved firms quietly working with some of the largest tech giants in the world.

That’s why we call them “Silent Partner” stocks.

Companies quietly profiting from a larger company’s deals.

My 2025 AI Blueprint includes three of these kinds of firms.

If investors can get in on them before the rest of the market catches on, it could be a great boon for their investments.

Can I guarantee that will happen? Of course not. No one can know for sure what the future will bring.

But consider the history in those 1,344 picks:

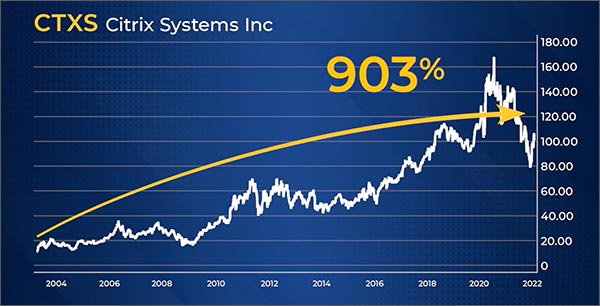

Microsoft needed Citrix, a software company, to help pull off one of its biggest, most important upgrades since Bill Gates first introduced Windows.

Citrix moved all the major Microsoft apps from personal computers where it had been stuck for decades …

Up into the cloud, where anyone can work from anywhere.

Lo and behold, Microsoft 365 was born, and Citrix exploded.

From the day Weiss Ratings first pegged Microsoft’s key partner as a “Buy” back in 2003, it went up as much as 903% by the time it was sold in 2022.

That’s good, but listen to this …

As Apple was launching the iPhone, there was a little, unknown company that made some chips.

No big deal. Except for one thing:

Apple needed these chips to connect iPhones to the internet, all kinds of Bluetooth devices and just about everything else.

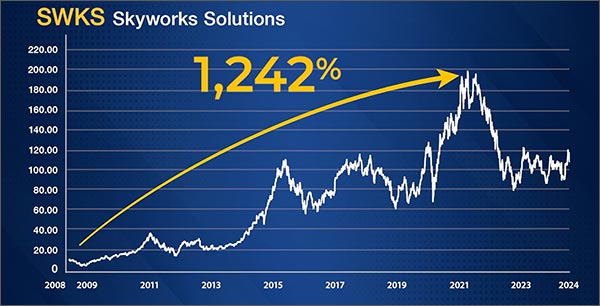

The company’s name? Skyworks Solutions, which practically no one had heard of …

But Weiss Ratings had …

That’s why it identified it as a “Buy” roughly three years earlier, in 2008.

And sure enough, iPhone profits started to roll in, and Skyworks shares gained as much as 1,242% in 16 years.

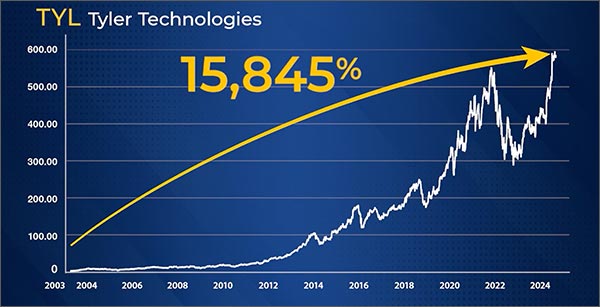

But if you think that’s a big gain, check out Tyler Technologies.

Since the day Weiss first announced that Tyler Technologies was a “Buy” in 2003, its shares didn’t rise just 1,000 or 2,000%.

No, they went up as much as 15,845% over 21 years …

And a big reason was Tyler Technologies’ work with Amazon.

AWS is the biggest cloud provider on Earth.

In just one second, it can handle 100 million requests.

It’s able to do this every second, hour after hour, day after day.

And AWS needed Tyler Technologies’ cloud solutions to make that happen.

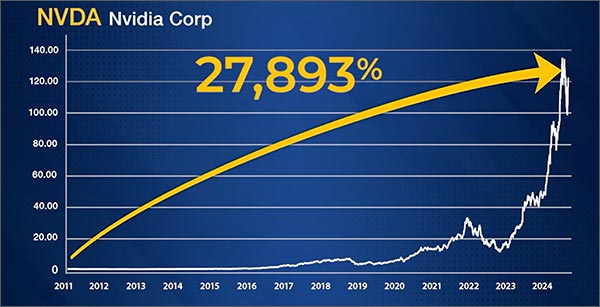

And let’s not forget about the biggest winner of them all … Nvidia.

Today, Nvidia is one of the most valuable companies on earth …

And it’s leading the biggest tech revolution of the century.

But few investors were aware of Nvidia back in 2011, when it was just a small tech company primarily known for producing gaming chips.

Weiss Ratings knew better …

We issued a “Buy” on Nvidia that year.

Around that time, Nvidia began a lucrative partnership with Microsoft.

Its next-generation graphics processing units, or GPUs, have been essential to Microsoft’s growth and dominance over the past decade.

And you know what happened next …

The price explosion of Nvidia’s shares dwarfed that of Tyler Technologies.

As much as 27,893%.

Does every company in the world that works with Big Tech nail these types of gains?

No. These were some of the biggest, from a select few partners.

But we don’t have to manually sift through the thousands — maybe millions — of deals out there …

To identify the needle-in-the-haystack ones that are highly rated.

Our ratings system does all the grunt work for us.

This is why we have an outstanding, 284% average gain on each and every one of our 1,344 tech ratings.

And that’s why I am here today.

Because Nvidia’s far and away the biggest winner when it comes to AI.

And I believe Nvidia’s silent partners could become some of the biggest stars of 2025.

Some of our favorites among them have ALREADY surged.

Like ASML, which has been up 500% …

Applied Materials, up as much as 562% …

SMCI, which went up as much as 3,244%.

Not to mention Taiwan Semiconductor, which soared as much as 6,583%.

They have all been playing crucial roles in Nvidia’s rapid rise.

And now that Nvidia has quickly taken over the AI data center sector …

With Big Tech pouring $1 trillion into them over the next few years …

I’ve found a new set of Nvidia’s silent partners that could be poised to break out.

And potentially become the next AI superstars.

That’s why they are the picks for my 2025 AI Blueprint.

So, here it goes …

2025 AI Blueprint Stock #1

The first stock in my 2025 AI Blueprint is not a household name.

But that doesn’t mean they aren’t collecting revenue hand over fist.

This company’s technology is directly or indirectly inside the devices used by more than 5 BILLION people.

That’s right … more than 5 billion people.

To put that in perspective, imagine every man, woman and child living in America.

Then imagine 16 countries with the same population as America lined up side by side.

That’s how many people interact with this company’s products every single day.

It’s in everything from supercomputers to smartphones.

Amazon, Apple, Google, Microsoft, Samsung, Qualcomm …

A who’s who of the world’s leading tech corporations depend on this company.

As well as a majority of the world’s population, which relies on it every day without even knowing it …

This company enables AI everywhere, including in AI data centers.

Now, they won’t lift a finger in their physical production.

But their blueprints will be all over them.

You see, AI data centers house an array of servers.

They’re equipped with powerful processors responsible for computation, data storage and network communication.

And this company’s designs are imperative for the development of the next generation of these processors.

This will allow AI data centers to achieve peak performance and minimize power consumption in considerably less time.

Nvidia CEO Jensen Huang even admitted recently that what Nvidia is trying to accomplish with AI data centers is “simply not possible” without this company.

And yet it’s still virtually unknown.

Practically no one is talking about this investment opportunity.

But that could change when investors discover its partnership with Nvidia.

The AI data center buildout that will continue to take place over the next decade and beyond needs Nvidia.

And Nvidia needs this company.

I share the name, ticker symbol and important buy price information in my special report, 2025 AI Blueprint: 3 Stocks for AI’s Next Boom.

2025 AI Blueprint Stock #2

Before I do that, though, let’s talk about the second 2025 AI Blueprint stock.

It specializes in helping AI data centers achieve peak performance …

By creating systems that can handle vast amounts of data at instantaneous speeds.

Remember how I mentioned that AI depends on enormous streams of data?

Well, the thousands of data centers that will be built in the coming years need advanced systems in place.

Networking tools, expensive chips, and other high-tech gear all need to work in concert with each other to crunch it all.

That’s where the second stock in my 2025 AI Blueprint comes in.

This company’s systems divert those immense streams of data to where they need to go … at lightning speeds.

I’m talking billionths of a second.

This prevents logjams and bottlenecks from occurring which could shut data centers down completely.

Basically, without these lighting transmission speeds, AI data centers are worthless.

Big Tech Giants like Microsoft and Meta need highly specialized equipment to operate AI data centers worldwide.

And it continues to make faster systems to get the job done.

With thousands more AI data centers on the way …

Equipped with this company’s tools …

I think we’re looking at a massive opportunity.

The valuable information you need to know about this company is included in my special report, 2025 AI Blueprint: 3 Stocks for AI’s Next Boom.

2025 AI Blueprint Stock #3

I’ll explain how to download that briefing shortly.

Before I do that though, let’s talk about the third 2025 AI Blueprint stock.

It has already aggressively carved out a lucrative niche in the data center market.

In fact, nearly three out of every four data centers worldwide currently employ its equipment.

AT&T, Ericsson, Siemens, Verizon and countless other clients rely on its innovative solutions.

And Nvidia needs it to support this AI data center network buildout that’s projected to add nearly 3,000 more mega structures by 2030.

You see, these massive new buildings will need an abundance of advanced AI servers.

We’re talking about millions of systems running around the clock …

Those AI servers will generate five times more heat than traditional servers.

It’s simple …

More heat means more cooling is needed.

Roughly ten times more per square foot in fact.

For those networks to continue running smoothly, they require support structures in place to temper the rising heat.

Enter my final 2025 AI Blueprint stock.

Its technology is ideally suited to counteract that enormous heat generation.

As AI continues to drive ravenous demand for computing power …

With AI data centers sprouting up around the world …

And with a long-term partnership with Nvidia in place …

The market for this company’s specific components is growing significantly.

And if it continues, its shares could follow.

The vital details can be found in my report, 2025 AI Blueprint: 3 Stocks for AI’s Next Boom, which can be claimed in the next few minutes.

2 Other AI Data Center Companies

Investors Need to Know

But first, while the three companies in my 2025 AI Blueprint are vital to this data center construction boom.

They aren’t the only companies that I think might receive a major boost.

In addition to my three 2025 AI Blueprint stocks …

I’ve found two bonus under-the-radar stocks that are also helping to power this AI data center explosion.

These companies have positioned themselves as being absolutely essential.

And I believe they could also be at the forefront of explosive growth in 2025 and beyond.

I’ve identified:

- A designer, from the ground up, of the chips, boards, platforms and even software needed for AI data center applications. This company functions as a gateway to the trillions upon trillions AI is expected to bring in over the next decade.

- A major supplier to technology juggernauts such as Apple and Tesla that is now charged with producing essential components that will enable AI data centers to function properly.

As their work on AI data centers becomes well-known, I predict their stocks could also become AI superstars.

We will send you the names and ticker symbols for these stocks as well …

And show why I believe these are the next partners that could explode.

All in our just-released report, 2 Under-the-Radar Companies Powering the AI Data Center Explosion.

This report is also available to download within minutes, along with my other stock market briefing: 2025 AI Blueprint: 3 Stocks for AI’s Next Boom.

But first, let me tell you a little more about myself …

I’ve been a leading tech analyst at the forefront of just about every major emerging technology story of the last decade.

3D printing. Gene editing. The mobile revolution. Big data. Cloud computing. And especially artificial intelligence.

As an investigative journalist, I’ve butted heads with the likes of Lee Iacocca …

And my book, Overdrawn, helped blow up the Savings and Loan scandal.

You may have read my exposés in The Wall Street Journal or the New York Times.

Or maybe you caught me railing against Wall Street corruption on the Larry King Show. I’ve also been on Fox Business, Bloomberg and CNBC.

I’ve even been nominated for a Pulitzer Prize.

But unlike most analysts, I have top-level access to technology-pioneering CEOs, prize-winning scientists and high-profile industry insiders.

That’s probably why I’ve been an advisor to 12 high-tech startups in Silicon Valley and served on the advisory board of a venture capital fund.

It’s this kind of access and boots-on-the-ground research that’s enabled me to consistently give investors the chance to benefit handsomely from remarkable breakthroughs.

In fact, in the last several years, I gave my readers the opportunity to score some extraordinary winners.

I already mentioned some of the best of the best – like Nvidia …

I recommended it at a split-adjusted 80 cents way back in 2016.

It’s up 18,510% since then.

Digital payment company Square has been up 702% since my recommendation in 2016.

I was in the room when the cloud computing industry was born.

An industry on pace to be worth $3 trillion.

Two of my picks in that sector surged …

Including Twilio, which rose as much as 354% in just two years.

And Veeva Systems, which gained 372% in a little over three years.

And I was early on Bitcoin as well.

I recommended it back in 2013 when it was trading around $300.

It’s been up 35,280% since then.

For 11 years, from 2013-2024, the average gain for all of my picks, including winners and losers, has beaten the S&P’s 15% average annual gains during the same period.

That includes my winners and losers.

And now, I’m all over this AI data center construction boom.

That’s why, today, I’m giving you this chance to get these urgent reports as my 2025 AI Blueprint unfolds …

Like Getting Nvidia at a Discount

But first, let me explain what’s especially exciting right now.

My research tells me that each of the five companies I’m talking about could play a vital role in this $1 trillion data center explosion.

As that takes place around the world, what do we think happens to their share prices?

I predict that they could soar thanks to the exponential growth of AI data centers…

And their partnerships with Nvidia.

The AI juggernaut appears set to revolutionize the industry again.

But to make that happen, it will need each of the companies I’ve included in my 2025 AI Blueprint …

As well as the two additional under-the-radar stocks I’ve included in my bonus report.

Bear in mind that, combined, their market cap is barely over 1/10th of Nvidia’s.

Yet, I cannot stress enough this: These AI companies are vital to Nvidia’s AI data center buildout.

Which is why I predict that as Nvidia continues to grow and dominate the AI sector, they could reap the benefits.

And I’m not making this prediction on a whim.

The fact is they are ALREADY helping to secure the future of both Nvidia and AI.

Tech giants around the world simply depend on them.

And now, Nvidia needs them to help make this $1 trillion AI data center pivot a booming success.

And that’s why I’m here, to talk about them before they potentially get too hot.

Among all of the tech revolutions I’ve seen in my lifetime – including things like the internet, gene editing and mobile computing – the AI revolution is the most far-reaching in its impact …

And it’s been extremely profitable for investors.

And it’s got legs.

That’s because this AI revolution is just beginning.

Which means that, despite its swift emergence …

We’re still in the preliminary stages.

So, the special reports today will give you a blueprint for the top AI stocks in 2025 …

But they’re also just the first of a long series of opportunities we’d like to bring to the table at Weiss Ratings.

That’s why I’m asking one favor today.

I’ll send you these special bonus reports – and the names of the select stocks partnered with Nvidia and their trillion-dollar pivot to data centers in just a moment.

I only ask you to give my monthly newsletter, Disruptors & Dominators, a try.

I was previously the Chief Investment Strategist for Trend Trader Daily and the Director of Technology Investing at Money Map Press.

For 10 years, I was also the chief strategist at Radical Technology Profits, giving my readers many fantastic opportunities along the way.

Now, I can’t imagine anything better for investors than the alliance I have made with Weiss Ratings.

With my deep industry knowledge, I’m among the first to take a deep dive into disruptive technologies that the public has heard very little about.

I’ve also been able to predict when they’re poised to become a big part of our daily life.

And I’ll give you that valuable intelligence in my monthly letter, Disruptors & Dominators.

As the name implies, this newsletter strives to show both sides of the great technological innovations we see in the world today.

It covers the new, rapidly emerging companies that I feel could disrupt the world for the better.

And, at the same time, it also covers the well-established companies that already lead their industry.

That’s what I consider the best of both worlds …

The chance for explosive opportunities …

And longer-term sustainable growth that comes from established industry leaders.

For my money, I want both.

And that’s what you get when you become a member of Disruptors & Dominators.

I’ve been in Silicon Valley for decades now.

And my access as a journalist has tipped me off to some of the biggest breakthroughs in history.

Well ahead of the market.

Like Nvidia, which has gone up 18,510% since I first spotted it in 2016.

And Bitcoin, which has gone up 35,280% since I first called it in 2013.

Digital payment company Square has been up 702% since my recommendation in 2016.

The S&P 500 averaged 15% annual gains between 2013-2024.

Over that same 11-year period, all of my picks, including my winners and losers, have surpassed that on average.

But with Disruptors & Dominators, you get something even more special.

I’m combining my stock expertise with the 53-year track record of Weiss Ratings.

Remember, Weiss Ratings has given 1,344 tech buys over the past two decades, with an average gain of 284%.

Including the losers.

Of those 1,344 picks, we’ve had some truly exceptional winners.

Like 39,864% on Apple in 20 years.

And 27,893% on Nvidia since Weiss Ratings rated it a buy back in 2011.

Or even 22,097% on Constellation Software in 16 years.

So, when you join Disruptors & Dominators today, you get the combined power of my decades of experience in Silicon Valley …

And the completely independent Weiss Ratings system – with an average gain of 284% on each and every “Buy”-rated stock in the last two decades across all winners and losers.

When you become a member of Disruptors & Dominators you’ll have access to the Weiss stock ratings, any time you like, on 12,500 stocks.

Plus, as a bonus, you’ll get both of my special reports:

- 2025 AI Blueprint: 3 Stocks for AI’s Next Boom

- 2 Under-the-Radar Companies Powering the AI Data Center Explosion

Then, on the first Friday of every month, we’ll send a new issue of Disruptors & Dominators, with a brand-new stock recommendation.

Either someone I believe is poised to dominate the market …

Or a company that appears on the verge of massively disrupting the market.

Like the three stocks that make up my 2025 AI Blueprint.

As well as the two additional AI data center stocks I share in my special report.

And when any news breaks about any tech stocks in the Disruptors & Dominators portfolio, my readers will be among the first to know.

I fill these issues with my lifelong tech expertise and award-winning writing.

Now, there is a cost for this letter …

But don’t worry.

We’re not going to charge thousands of dollars.

In fact, we’re not even going to charge $100.

We want to give subscribers a chance at a leg up on the so-called Wall Street “insiders.”

So, there’s no reason everyone shouldn’t get access to our high-quality research and investment analysis.

How do you sign up for Disruptors & Dominators?

But, I have one more unique opportunity I’d like to share very quickly.

BONUS: The U.S. Government’s Favorite AI Stock

Look, AI’s limitless possibilities, especially with the exponential growth in AI data centers, are a big deal. They are the future of technology.

But some harsh realities mean we must focus on the present, too.

That’s because there is a digital plague among us.

I’m talking about cybercrime, which, according to a recent global report, is projected to cost 10.5 trillion this year alone!

That would be the world’s third largest economy behind the United States and China.

“The greatest transfer of wealth in history.”

- Keith Alexander

Director, National Security Agency

According to former director of the National Security Agency and retired four-star general Keith Alexander, this amounts to:

And the U.S. Government itself is not immune to these attacks either.

Federal agencies reportedly lose millions a year.

That’s where the tech innovators at my last pick come into play.

They leverage AI to detect more than one million cyber-attacks every single day.

With their unique industry knowledge, they’re able to advise the U.S. Government on AI and cybersecurity.

And that’s not all.

They sell AI-based security services to the Fortune 100 …

And 79% of Global 2000 firms.

And the cherry on top?

They just announced a high-priority collaboration with Nvidia that is intended to drastically enhance several of their platforms.

That’s why I have created a unique bonus report on The U.S. Government’s Favorite AI Stock.

Inside, I explain how this company acts as the first line of defense in protecting trillions of dollars around the world.

And how it’s helping to protect the Western world from cybercrime.

Now, here’s what I like most about them: they’re positioned for stability, long-term stability.

Why?

Because they’ve got so many US government contracts. That makes them an extremely attractive play in the long term.

I think they’ll be a pillar of the AI market for many years to come.

You’ll have the opportunity to immediately download a copy of The U.S. Government’s Favorite AI Stock.

Not to mention our 2025 AI Blueprint …

As well as our bonus report on the two under-the-radar companies powering AI data centers.

All three reports are yours as a bonus, when you become a member of Disruptors & Dominators.

But with your membership, you’ll also get a whole lot more.

You’ll get 12 monthly issues of Disruptors & Dominators, full of executive quality research on the exciting world of tech investing.

You’ll get my decades of tech investing experience, as well as my Silicon Valley expertise.

All to uncover what I think are some of the best tech stock picks in the world today.

Dominating stability PLUS the potential for disruptive growth.

Together. In the same membership. At the same time.

As the tech market continues to grow and diversify …

You need someone with an astute eye for great opportunities and a calm, prudent voice providing valuable insights.

I’ve been doing this for 40 years, through ups and downs.

Finding the right investments and timing them throughout MANY tech booms.

I’ve got an eye for the next disruptive breakthrough.

Now, here’s one more thing …

If you aren’t satisfied at any time for any reason during your first 12 months …

Just call my team and they’ll give you a full refund with no questions asked.

You can keep every issue, every bonus report, and every alert you’ve received.

That means you get a full year to try out and enjoy our service.

And if you don’t like it, just let us know any time, right up to the last day of your membership.

Now, as part of your membership with Disruptors & Dominators, you will receive nine comprehensive, immediately actionable benefits:

- BENEFIT #1. A full 12 months of access to Disruptors & Dominators (sold separately for $109)

- BENEFIT #2. 2025 AI Blueprint: 3 Stocks for AI’s Next Boom (sold separately for $79)

- BENEFIT #3. 2 Under-the-Radar Companies Powering the AI Data Center Explosion (sold separately for $79)

- BENEFIT #4. The U.S. Government’s Favorite AI Stock (sold separately for $79)

- BENEFIT #5. The User’s Guide to Disruptors & Dominators. I’ll explain my unique investing philosophy and how to use it.

- BENEFIT #6. One year of access to our 53,000 Weiss Ratings, including not only stocks but also ETFs, mutual funds, and other sectors (previously sold separately for $228)

- BENEFIT #7. My Flash Alerts for critical, time-sensitive opportunities and warnings (priceless)

- BENEFIT #8. Huge Savings! The total value of this welcome package is $574.

- BENEFIT #9. My Unconditional 365-Day 100% Money-Back Guarantee

One year of Disruptors & Dominators has retailed for $109.

But a trillion-dollar AI data center buildout is upon us.

And a new blueprint for AI investing in 2025 is quickly taking shape.

I don’t want you to miss out on this.

So, today, you will get a full year of access to everything for just $49.

That’s less than the cost of a tank of gas.

In fact, it’s less than 14 cents per day.

I think you’ll agree that it’s more than fair, especially given the explosion of artificial intelligence and all the benefits it’s bringing to investors.

With the six AI stocks we’ll share with you today, you’ll have what I think is the very best chance to capitalize on this powerful and sustainable revolution this year.

If you wait around and watch as the companies in my 2025 AI Blueprint potentially make it on the cover of The Wall Street Journal – it could be too late.

I’ve uncovered dozens of great tech stocks, long before the market knew about them.

I think I’ve found a few more right now.

The AI market is moving fast. And while the companies in my 2025 AI Blueprint are behind the scenes today.

They could suddenly become front page news at any time.

With Disruptors & Dominators, you’ll have a front row seat for the next phase of this tech revolution.

Join now …

Click the button below to join Disruptors & Dominators and get the names of the three companies included in my 2025 AI Blueprint – and all your other bonuses, rushed to you right now.

I’m Michael Robinson. Thanks so much for joining me.